Power consumption of Vietnam is expected to increase from 10-12% until 2030 and become top increase in power consumption of Asia countries. Total power installation capacity for Vietnamese electricity plants are 56,000 MW (56 GW) according to IEV report dated March 2021.

In February 2020, with Resolution No. 55/NQ-TW of the Central Committee – Communist Party of Vietnam regarding Strategy to develop power sources of Vietnam until 2030 with outlook to 2045, total power installation capacity will increase to 125,000 to 130,000 MW (125-130 GW). In other words, it is the double in capacity in 10 years.

In Electricity Zoning VIII, up to 2021, thermal powerplant consisted of 50% total power generation and will reduce to 40% in 2031. There will be no more coal fired powerplant to be built, except for those already in construction. The government wants to develop the electricity production sustainably and environmentally friendly, with renewable energy and liquified gas electricity, etc.

Until 2030, Vietnam has about 30 coal fired power plants at different sizes from North to South; in which, northern plants are those with old burning technology from China, using local coal – anthracite. On the other hands, middle and southern plants are using modern burning technology, more environmentally friendly and some of them are using imported coal.

Coal consumption (both domestic and imported) of power plants is about 50 million tons/year. Respective quantity of fly ash is 16 million tons/year. In Vietnam, fly ash is becoming valuable resource for construction materials: cement, concrete production, and landfill, rather than being considered as industrial waste as before.

The most difficult matter in consumption of fly ash from the coal fired power plants at the moment is the quality control. There are two important factors affecting the strength activity index of cement is fineness and loss on ignition (LOI).

Regarding loss on ignition, the coal fired power plants are actively adjusting the operation process and the blending of anthracite and bituminous coal, resulted in positive changes in loss on ignition. For example, 5 years ago, LOI of Duyen Hai 1, Vinh Tan 1 and Vinh Tan 2 fly ash are from 10 to 12%, but reduced to 4 to 5% in 2023, whereas American Standard ASTM C618 only requires LOI to be less than 6%, which is now totally suitable for export.

Regarding fineness, it is the most important factor to strength activity index of cement (R7, R28). Most precast concrete producers in the south of Vietnam always request fly ash supplier to control the retained content on sieve 0.045 mm <15%. However, this is impossible without classification of fly ash. Most fly ash from power plants in Vietnam has retained content on sieve 0.045mm from 20 to 25%. If the rate is stable, fly ash is still usable for producers; however, the rate in reality is unstable following coal burnt status of the powerplant.

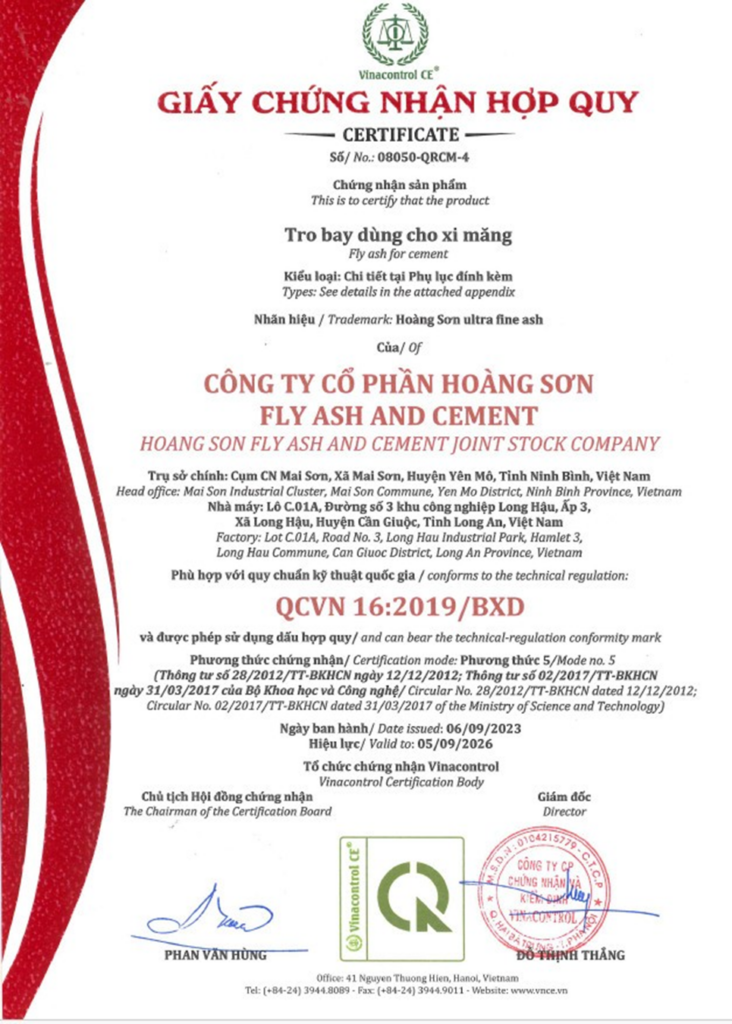

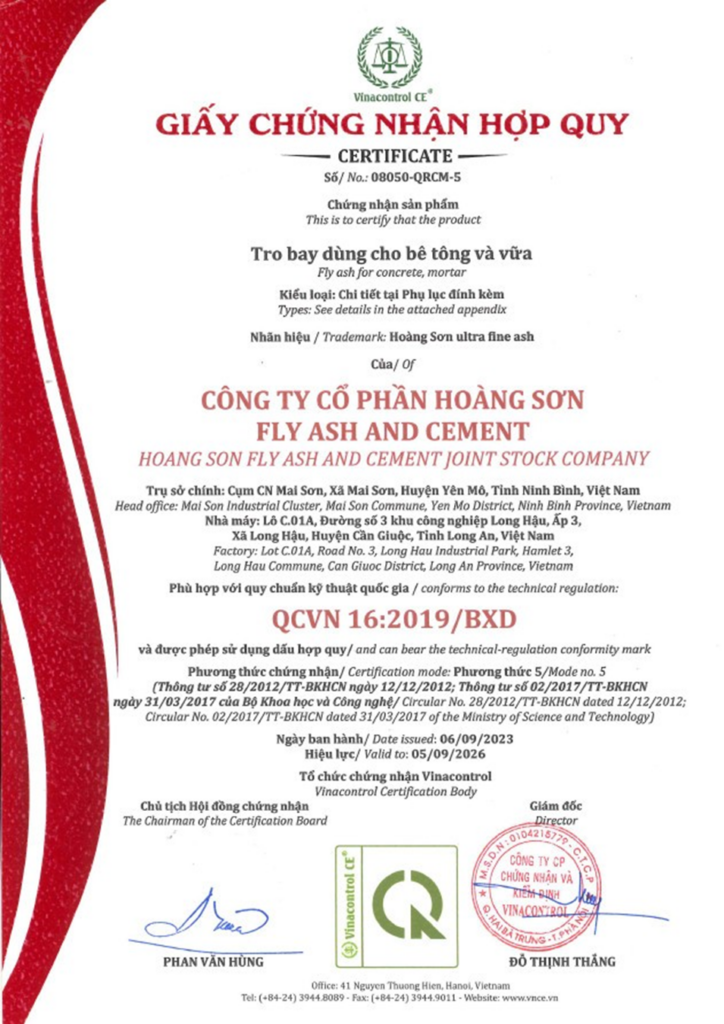

Hoang Son Fly Ash And Cement JSC, a member of EPPM Gmbh network, is the pioneer in green transformation in construction material market. Understanding the importance of quality control, Hoang Son invested in a fly ash processing plant using German technology by Christian Pfeiffer with classifying capacity of 900,000 tons/year at Long Hau Industrial Park, Long An. The purpose is to classify fly ash to ensure the fine product meets EN-450 standard.

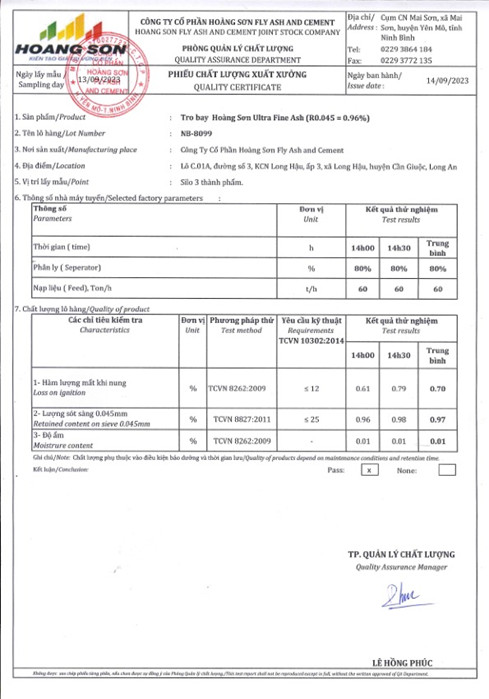

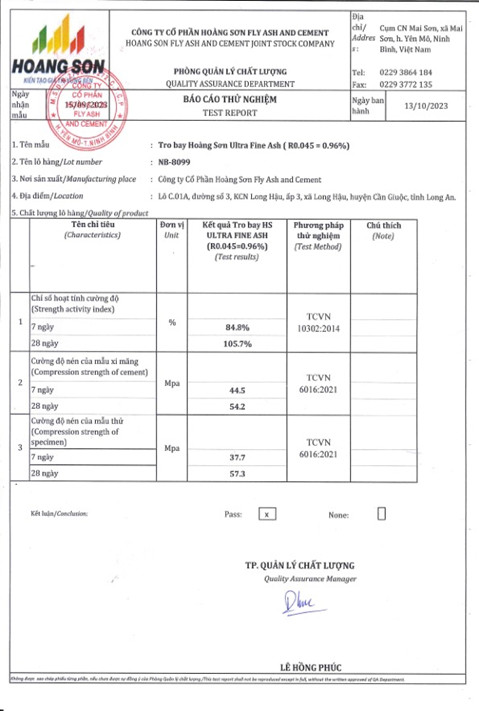

After testing and conformity process, in October 2023, Hoang Son fly ash processing plant officially introduced to the market new product – Hoang Son ultra-fine fly ash. The fly ash has both LOI and retained content on sieve 0.045 mm of less than 1%. Also, our technical team tested strength activity index of cement with Hoang Son ultra-fine fly ash and R28 result is 105% compared to cement without fly ash.

Some pictures and documentation about the product:

a. Conformity:

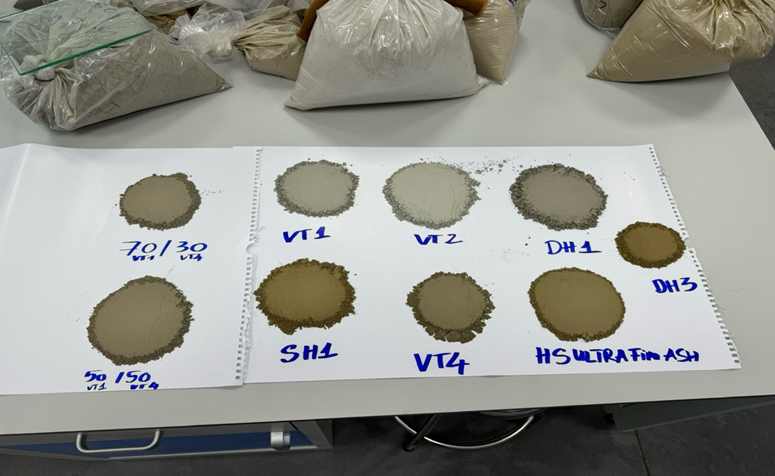

b. Color comparison with raw fly ash:

c. Most recent test results:

With the initial positive result, in the upcoming future, Hoang Son Fly Ash And Cement JSC is looking forward to boost market consumption of ultra-fine fly ash and develop other classified fly ash products to serve market demand. For example, besides quality, fly ash must ensure similar color with cement, which is one of the challenges for the domestic fly ash consumers in Vietnam in order to consume more fly ash from the coal fired power plant in the future.